Fiscal Year 2025/2026 Narrative

Sewer Utility Fund

The Key Largo Wastewater Treatment District (“District”) was formed as an autonomous independent Special District and political body formed in 2002 by the Legislature of the State of Florida by House Bill 471, enacted as Chapter 2002‐337, Laws of Florida, for the purpose of carrying out the planning, acquisition, development, operation, and management of a wastewater management system within the District’s boundaries in Key Largo, Monroe County, Florida.

The District operates and maintains a wastewater utility from mile marker 91 to 106 and southern portions of C‐905 in North Key Largo. It provides service to approximately 10,500 improved parcels and approximately 10,205 accounts are billed monthly, representing approximately 14,990 EDUs. Operating as an enterprise fund, customer charges and assessments pay for the cost of operations and maintenance, debt service, and administrative costs.

Fund Overview

The District is structured on the basis of one individual enterprise fund. An enterprise fund is established by a government to account for activities similar to private business operations. The intent is that user charges make up for the costs of providing goods or services to the public. Enterprise funds use the accrual basis of accounting. Under this method of accounting revenues are recorded when earned and expenses are recorded when the liability is incurred, regardless of when the cash is received or paid. Also, all assets and liabilities associated with the entity are included on the balance sheet. Generally, accepted accounting principles applicable to enterprise funds are similar to those applicable in the private sector.

Table of Contents

- Sewer Utility Fund

- Fund Overview

- Budget Development

- Revenue Overview

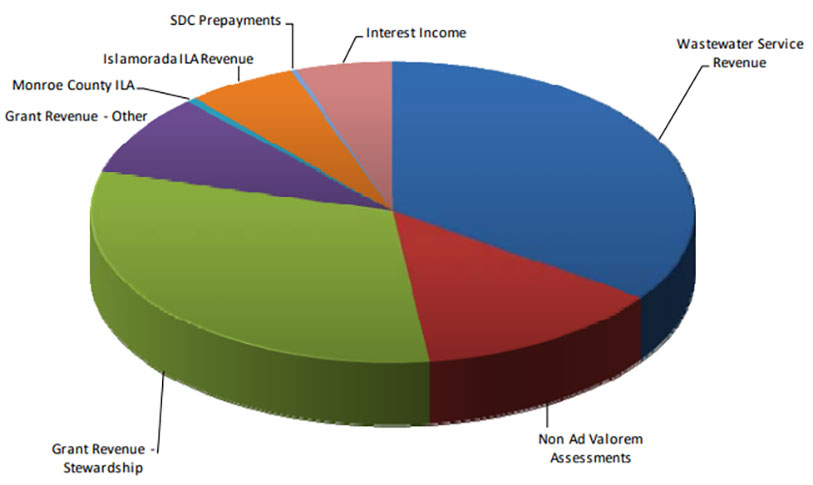

- Where the Money Comes From

- Wastewater Service Revenue ($8,002,067)

- Non Ad Valorem Assessments ($3,098,450)

- Stewardship Grant Revenue ($7,225,000)

- Grant Revenue – Other ($2,000,000)

- Monroe County ILA ($125,000)

- Islamorada Wastewater Service & Insurance Surcharge Revenue ($1,368,000)

- System Development Charge Advance Payoff Revenue ($75,000)

- Interest Income ($1,200,000)

- Miscellaneous Income ($55,000)

- Expenditure Overview

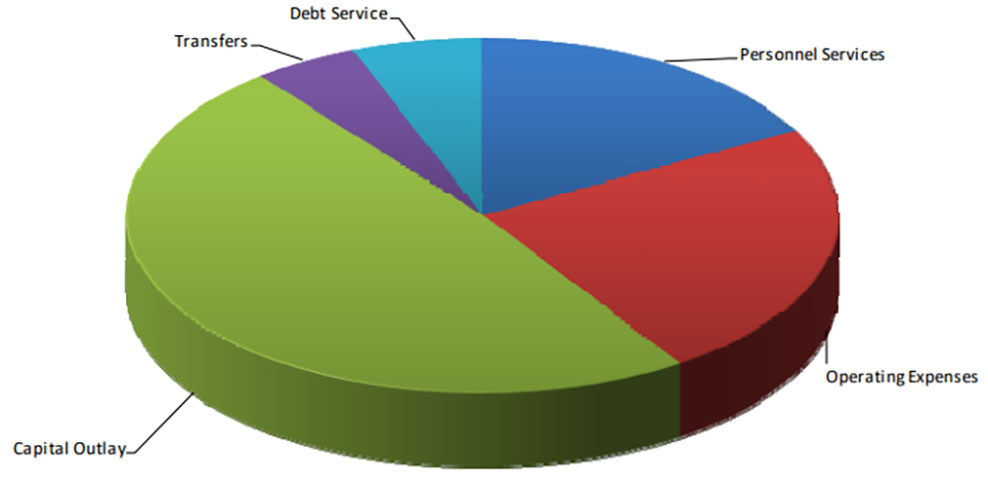

- Where the Money Goes

- Personnel Services ($4,493,455)

- Operating Expenses ($6,116,632)

- Capital Outlay ($12,699,984)

- Debt Service ($1,558,961)

- Transfers ($1,250,000)

Budget Development

The annual budget is considered one of the most important documents adopted by the District’s Board of Commissioners each year. The budget reflects the District’s financial policies for the upcoming year by allocating the sources of funds for District services, and projecting expenditures for those services.

The District is focused on improvements that will continue to supply high quality service to our customers. Staff will continue to focus on the collection and disposal of wastewater in the most effective and efficient methods available. External funding sources, including grants, will continue to be aggressively sought.

Revenue Overview

The FY25‐26 projected revenues and other sources of the District are as follows:

| FY 2025‐26 Budget |

% of Total | FY 2024‐25 Budget |

% of Total | |

| Wastewater Service Revenue | $8,002,067 | 30.64% | $7,600,000 | 28.87% |

| Non Ad Valorem Assessments | 3,098,450 | 11.86% | 3,295,000 | 12.52% |

| Grant Revenue ‐ Stewardship | 7,225,000 | 27.66% | 5,659,628 | 21.50% |

| Grant Revenue ‐ Other | 2,000,000 | 7.66% | 4,066,373 | 15.45% |

| Monroe County ILA | 125,000 | 0.48% | 2,125,000 | 8.07% |

| Islamorada ILA Revenue | 1,368,000 | 5.24% | 1,366,000 | 5.19% |

| SDC Prepayments | 75,000 | 0.29% | 100,000 | 0.38% |

| Interest Income | 1,200,000 | 4.59% | 900,000 | 3.42% |

| Miscellaneous Revenue | 55,000 | 0.21% | 100,000 | 0.38% |

| Planned Use of Repair & Replacement Reserves | 3,221,559 | 12.33% | 2,346,118 | 8.91% |

| Use of/(Addition to) Reserves | (251,070) | ‐0.96% | (1,230,570) | ‐4.67% |

| $ 26,119,006 | 100% | $ 26,327,549 | 100% |

Where the Money Comes From

Wastewater Service Revenue ($8,002,067)

The District’s revenues, charges for wastewater services represent the largest source of budgeted operating revenue for the District. This revenue is derived by providing sewer collection and treatment services to the public. Users are charged for this service on their monthly water bill from the Florida Keys Aqueduct Authority (“FKAA”). Customers are charged a base service charge and a usage charge, which is based on their monthly water consumption.

Non Ad Valorem Assessments ($3,098,450)

Non ad valorem assessments revenue is the annual assessments of system development charges to customers for providing the sewer infrastructure. Initially, assessments were levied in phases and customers were given the option to prepay the assessment in full, or to have the assessment spread over 20 years as a non ad valorem assessment on their tax bill from Monroe County. The assessment charge is calculated on the number of equivalent dwelling units (“EDU”) for the serviced parcel. An EDU represents the equivalent to a single family unit and is based on 167 gallons per day of potable water usage.

Stewardship Grant Revenue ($7,225,000)

The District was awarded Stewardship funding from the State of Florida. This cost reimbursable grant program will fund several of the District’s capital projects.

Grant Revenue – Other ($2,000,000)

The District anticipates that it will receive $1,000,000 from the Federal Government through the Army Corps of Engineers for the reimbursement of capital project expenditures that are included in the project cooperation agreement (PCA). The District is also anticipating $1,000,000 from the Resilient Florida Grant for mitigation work.

Monroe County ILA ($125,000)

The District successfully negotiated an interlocal agreement with Monroe County to exchange the $17,000,000 of Stan Mayfield funding that the State allocated to the District in FY13/14. In FY15/16 the District exchanged $1,250,000 of Stewardship funding in return for annual payments from the County of funds that have an unrestricted use.

| Stan Mayfield Funding Exchange | $ 17,000,000 |

| Stewardship Bill Funding Exchange | 1,250,000 |

| Payments received from Monroe County | (17,875,000) |

| Balance due from Monroe County | $ 375,000 |

| Expected Mayfield $17M & Stewardship |

|

| 2026 | $125,000 |

| 2027 | 125,000 |

| 2028 | 125,000 |

| $375,000 | |

Islamorada Wastewater Service & Insurance Surcharge Revenue ($1,368,000)

The District and Islamorada, Village of Islands (“Village”) have an interlocal agreement for the use of 32% of the District’s plant capacity. The Village is charged a base rate of $4.65 per 1,000 gallon of influent, not including any rate surcharges, at the District’s advanced wastewater treatment plant. That rate is calculated at $4.30 for treatment cost and $0.35 for repair and replacement funding. The District began receiving flows from the Village on June 16, 2014.

The Interlocal agreement with the Village requires them to pay 32% of the insurance expense for the advanced treatment plant. The District invoices the Village annually for this surcharge.

System Development Charge Advance Payoff Revenue ($75,000)

Customers have the option to pay off their system development charge at any time. Although substantially all of the serviced parcels have been assessed, customers may choose to either pay down or pay off their assessment in advance.

Interest Income ($1,200,000)

The District is projected to earn interest income in FY25/26 from its interest bearing accounts and investing activities.

Miscellaneous Income ($55,000)

The District is projected to earn miscellaneous income in FY25/26 from various sources.

Expenditure Overview

The total projected appropriations of this budget are $26,119,006. The following chart shows a summary of the budgeted appropriations by category:

| FY 2025‐26 Budget |

% of Total | FY 2024‐25 Budget |

% of Total | |

| Personnel Services | $4,493,429 | 17.20% | 4,012,440 | 15.24% |

| Operating Expenses | 6,116,632 | 23.42% | 5,669,211 | 21.53% |

| Capital Outlay | 12,699,984 | 48.62% | 13,836,937 | 52.56% |

| Transfers | 1,250,000 | 4.79% | 1,250,000 | 4.75% |

| Debt Service | 1,558,961 | 5.97% | 1,558,961 | 5.92% |

| $ 26,119,006 | 100% | $ 26,327,549 | 100% |

Where the Money Goes

Personnel Services ($4,493,455)

Personnel Services includes all salaries and benefits (including workers compensation insurance) for District employees.

| Department | FY25‐26 FTE |

FY25‐26 Budget |

FY24‐25 FTE |

FY24‐25 Budget |

| Commissioners | NA | $71,218 | NA | $69,076 |

| Administrative | 6 | 769,833 | 6 | 735,586 |

| Plant | 5 | 701,785 | 6 | 655,847 |

| Field | 17 | 2,025,987 | 17 | 1,766,665 |

| Facilities | 8 | 924,606 | 7 | 785,266 |

| Total | 36 | $4,493,429 | 36 | $4,012,440 |

Operating Expenses ($6,116,632)

FY25/26 will be the sixteenth year of full operations.

Capital Outlay ($12,699,984)

The FY25/26 budget includes appropriations for capital outlay. The following chart provides the details

on the specific capital outlay items requested.

Capital Outlay Items

| Capital Improvements (includes Engineering Design & CEI) | |||

| Odor Control at Vac Stations | 2,560,000 | ||

| Effluent Filtration Upgrade | 50,000 | ||

| Power Conditioning & Electrical Upgrades WWTP | 1,316,000 | ||

| EQ Tank Headworks | 2,700,000 | ||

| Vac Station Ventiliation Upgrades | 441,125 | ||

| Replace Vac Pit Collars | 20,000 | ||

| Ductile Iron Piping Corrosion | 1,250,000 | ||

| Vac System Monitoring | 680,000 | ||

| Engineering: Capital Prelim Design & Bgt | 35,000 | ||

| Engineering: Power Conditioning Vac Stns | 61,275 | ||

| Engineering: Vac Stn Sewage Tank Upg | 400,000 | ||

| Engineering: Coll Sys Action Plan (SAP) | 100,000 | ||

| Engineering: Service Connection Revision | 20,000 | ||

| SCADA Upgrade 3 servers | 120,000 | ||

| Capital Outlay: Vac Pump Rebuild & Spare | 67,500 | ||

| Capital Outlay: Grinder Pumps | 21,000 | ||

| Capital Outlay: Field Ops Truck | 70,000 | ||

| Capital Outlay: Admin Vehicle | 32,000 | ||

| Vac Tank Replacement | 2,500,000 | ||

| Capital Outlay ‐ Computer Equipment | 56,000 | ||

| Service Connection Construction Revision | 75,000 | ||

| Sewage Pump VFD Spares | 47,000 | ||

| Diffuser Sleeves for 1 tank | 26,000 | ||

| Additional Security Cameras at Plant | 10,000 | ||

| Vac Tron Tank Replacement | 27,084 | ||

| New Hydraulic Pump and Power Unit | 15,000 | ||

| Total Capital Outlay | $ 12,699,984 | ||

These projects, while budgeted, are still subject to board approval

Debt Service ($1,558,961)

The FY25/26 budget includes appropriations for debt service on the District’s one State Revolving Fund (SRF) loan. The SRF loan is paid semi‐annually.

| Debt Obligation | Loan Balance @ 9/30/25 |

Annual Debt Service Principal Reducation |

Loan Balance @ 9/30/26 |

| SRF Loan 46401P | $5,887,567 | $1,415,571 | $4,471,996 |

Transfers ($1,250,000)

The FY25/26 budget includes transfers to the District’s following reserve accounts: repair and replacement, self‐insurance and insurance deductible. $1,200,000 is projected to be transferred to the reserve for future repairs and replacements. The ILA with the Village also requires that $0.35 of the $4.65 flow charge be set aside for future repairs and replacements. The District is also going to reserve $50,000 for insurance deductibles and for self‐insurance. FY25/26 is the eighth year a contribution will be made to the self insurance & insurance deductible fund. At the end of FY25/26, the District expects to have $13,250,000 in funding designated for repairs and replacements, $5,375,000 for insurance deductibles and self‐insurance.

| Budgeted Transfer to R&R fund | $ 1,200,000 | |

| $0.35 of Islamorada Flow Charge | (97,849) | |

| Total Required Transfer to R&R fund | (97,849) | |

| Amount in EXCESS of minimum requirement | $ 1,102,151 |

Excess reserve funding is required to meet the actual reserve and replacement funding necessary based on the engineering estimates. These reserve categories are important due to the District’s unique island location. The District’s goal is to maintain twelve months of operating expenses in unassigned cash as a reserve balance.

| Unassigned Cash Balance as of Sept 30, 2024 | $ 21,428,703 | |

| Projected Revenues & Planned Used of Reserves FY24‐25 | $ 18,802,579 | |

| Projected Expenditures & Reserve Transfers FY24‐25 | (15,243,776) | |

| Projected Revenues in excess of Expenditures & Reserve Transfers FY24‐25 | 3,558,803 | |

| Expected Unassigned Cash Balance as of Sept 30, 2025 | 24,987,506 | |

| Budgeted Revenues & Planned Use of Reserves FY25‐26 | $ 26,370,076 | |

| Budgeted Expenditures & Reserve Transfers FY25‐26 | (26,119,006) | |

| Budgeted Revenues in excess of Expenditures & Reserve Transfers FY25‐26 | 251,070 | |

| Expected Unassigned Cash Balance as of Sept 30, 2026 | $ 25,238,576 |